Exela Technologies is a beaten-down penny stock, but it has two huge things going for it: it’s a software and AI stock.

Exela Technologies is a beaten-down penny stock, but it has two huge things going for it: it’s a software and AI stock.

I expect AI stocks in general to rise into a bubble over the next few years; we’ve already seen it start since February 2023. Most of the Nasdaq100 gains recently are related to the AI bubble. The Nasdaq is overbought because of AI, but many of the growth names are still yet to rise. So you don’t want to buy growth AI as a near-term trade just in case the Nasdaq declines over the next few weeks or even months; however, if you have a longer investment horizon, some of these AI growth names make a lot of sense to buy into as worthwhile risk-reward plays.

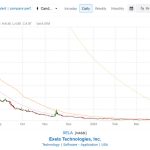

Exela is not a loved stock right now — most financial analysts say to stay away because it’s a hopeless company. But rarely do companies that have made it as far as Exela truly die off and disappear; I watch time and time again stocks crash and then after a 6-month span begin to rise again once their problems begin to fade. I love putting some money on penny stocks that were mid-cap names within the last few years. And Exela is one of the stocks I’m watching closely for the rest of this year.

AI is a multi-layer opportunity. One of the layers that benefit from AI is the application layer, meaning software stocks. Most asset managers admit that they don’t know what application layer stocks are going to be the winners. When it comes to penny stocks, any company that uses AI as an application layer has the potential to rise back to the price it once came from all else being equal with the company’s objectives.

Exela has a market cap of 40.46M and institutional ownership sits at 9.40%. Exela has an RSI of 41.29 and a short float of 2.61%. There have been no insider transactions over the last 6 months for Exela.